All Categories

Featured

Table of Contents

Instead, your research study, which might entail skip tracing, would set you back a relatively tiny cost.

Your resources and technique will identify the most effective setting for tax overage investing. That stated, one technique to take is accumulating passion above costs. Therefore, capitalists can buy tax obligation sale excess in Florida, Georgia, and Texas to make the most of the premium bid laws in those states.

Market Analysis

Furthermore, overages put on greater than tax obligation deeds. Any public auction or foreclosure involving excess funds is an investment opportunity. On the flip side, the major disadvantage is that you could not be awarded for your effort. For example, you can spend hours looking into the past proprietor of a home with excess funds and contact them just to discover that they aren't curious about going after the cash.

You can begin a tax obligation overage organization with marginal expenses by finding information on current residential properties marketed for a premium proposal. Then, you can speak to the past proprietor of the residential or commercial property and provide a price for your solutions to help them recoup the excess. In this situation, the only cost entailed is the study instead of investing tens or numerous countless bucks on tax liens and actions.

-min.png?width=754&height=425&name=1%20-%20Blog%20Feature%20Image%20Dump%20(12)-min.png)

These excess generally create passion and are offered for previous proprietors to claim. Whether you spend in tax liens or are only interested in cases, tax obligation sale excess are investment chances that need hustle and strong study to turn a profit.

What Is The Most Valuable Training For Real Estate Claims Investors?

Pro Members Get Full Gain access to Succeed in genuine estate spending with proven toolkits that have helped hundreds of aiming and existing financiers accomplish economic flexibility. $0 TODAY $32.50/ month, billed each year after your 7-day trial. Cancel anytime.

These homes are offered for sale "AS IS", at the threat of the buyers and neither the Region nor any various other celebration makes warranties or representations whatsoever either shared or suggested, of any kind, with respect to the properties or the title thereto. In case a tax sale certification is issued and after that nullified by the Supervisor of Financing with no fault of the purchaser just a reimbursement of quantities actually paid on the day of sale shall be made and will be the Supervisor of Money's sole responsibility and restriction thereon.

The sale, the premises, and the buildings are, to the extent given by regulation, based on any and all title defects, cases, liens, encumbrances, covenants, problems, restrictions, easements, right of way and matters of documents. In case of a blunder, defective title, summary or non-existence of property, no reimbursement shall be provided.

What Is The Most Important Thing To Know About Financial Education?

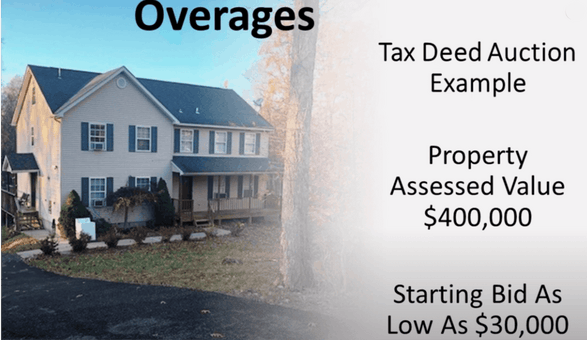

Tax obligation sale overages occur when a tax-foreclosed building is sold at auction for a higher rate than the owed taxes., additionally called overages, are the distinction between the sale price and the taxes due.

Excess proceeds healing is a legal procedure that allows homeowner to recuperate any excess funds (additionally referred to as Overages) left over after a building has actually been cost a tax obligation sale. In Texas, the procedure of excess profits healing can be intricate, and it's important to have a seasoned attorney in your corner to guarantee that you get the total of funds owed to you.

In this article, we'll offer an introduction of excess profits recuperation and the actions you require to take to declare your funds (wealth creation). Excess earnings are the funds left over after a residential or commercial property has actually been cost a tax obligation sale for greater than the amount of delinquent tax obligations, penalties, interest, and costs owed on the building

What Is The Most Comprehensive Course For Understanding Training Resources?

These consist of:: You have to file a claim for the excess proceeds with the region district court in the county where the residential property was offered. The case must be submitted within the defined time period, generally 2 years from the date of the sale. Residential or commercial property videotaped in the name of a corporation should be stood for in court by a lawyer in Texas.

Each area court typically has certain documents and sustaining evidence required for recovery of excess proceeds.: You may be needed to pay court or filing fees to file your case, along with any type of extra administrative & processing fees required to get your excess proceeds.: If there are several claims on the excess profits, a hearing may be needed to determine the rightful proprietor.

At the we can help you with every step of the excess proceeds recovery process. revenue recovery. Our knowledgeable lawyers can aid you sue, offer the needed documents and research, defend you and your insurance claim versus contending claimants and represent you at any type of required hearings. If you are a building proprietor or lienholder in Texas, you might be entitled to excess earnings from a tax obligation sale

What Are Bob Diamond's Top Recommendations For Investment Blueprint?

Any kind of monies continuing to be after the satisfaction of the tax obligation sale are thought about to be Excess Earnings. Celebrations of Interest might assert the Excess Earnings within a given period of time (Profits and Taxes Code (RTC) 4671 et seq.).

Cases are submitted with the Auditor-Controller, Residential Property Tax Obligation Division. Early receipt is recommended as there is no elegance period. The Plaintiff bears the duty to make certain delivery. Consequently, it is advised that some kind of postal solution tracking be made use of when mailing a Claim, particularly if near the deadline.

What Is The Most Practical Course For Successful Investing Education?

Template Insurance claims are available in the kinds area on this page (pick one design template Insurance claim per Plaintiff). Following the expiry of the asserting duration, the Auditor-Controller will certainly offer valid Cases in a Board of Manager's (BOS)public hearing. Cases will not be listened to by the BOS until after the claiming duration has actually expired.

Latest Posts

Tax Sale Overages Course

Back Tax Houses For Sale

What Is Tax Lien Certificates Investing